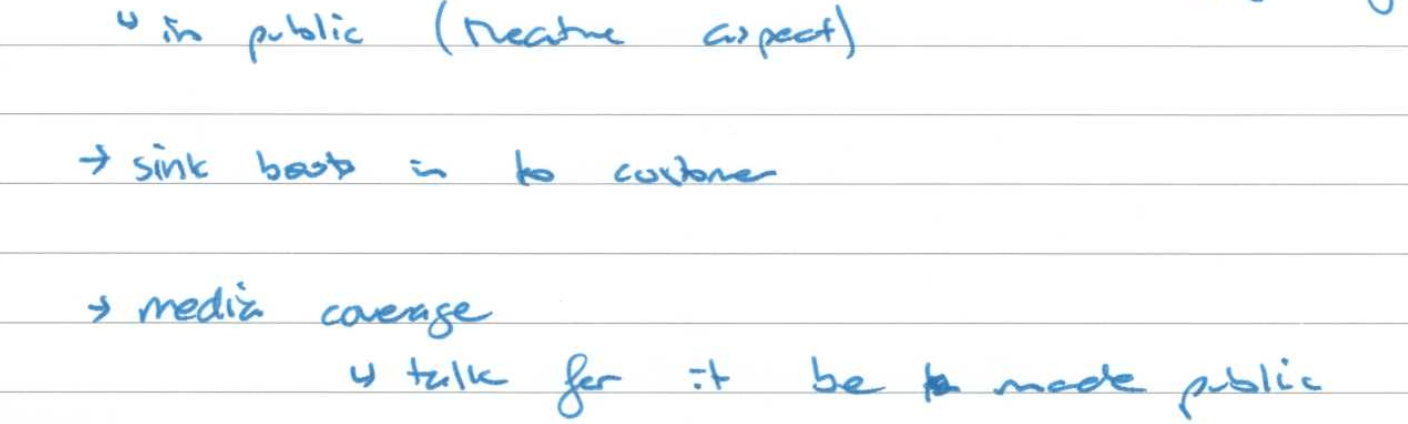

SINK BOOTS INTO CUSTOMER

Link to the full memo at: DOC131

Instruction From Bankwests Head of Legal and Government affairs

to Bankwests appointed Taylor Woodings (now called FTI Consulting)

and their Lawyers acting "on behalf of customer"

and supposedly acting in the interests of the customer.

They then prepared a litany of lies to present to a Senate hearing.See below

Senate video of Bankwest appointed FTI Consulting manager

A lying Bankwest Corporate thug. Body Language says it all: Click LINK

Link to the full memo at: DOC131

Instruction From Bankwests Head of Legal and Government affairs

to Bankwests appointed Taylor Woodings (now called FTI Consulting)

and their Lawyers acting "on behalf of customer"

and supposedly acting in the interests of the customer.

They then prepared a litany of lies to present to a Senate hearing.See below

Senate video of Bankwest appointed FTI Consulting manager

A lying Bankwest Corporate thug. Body Language says it all: Click LINK